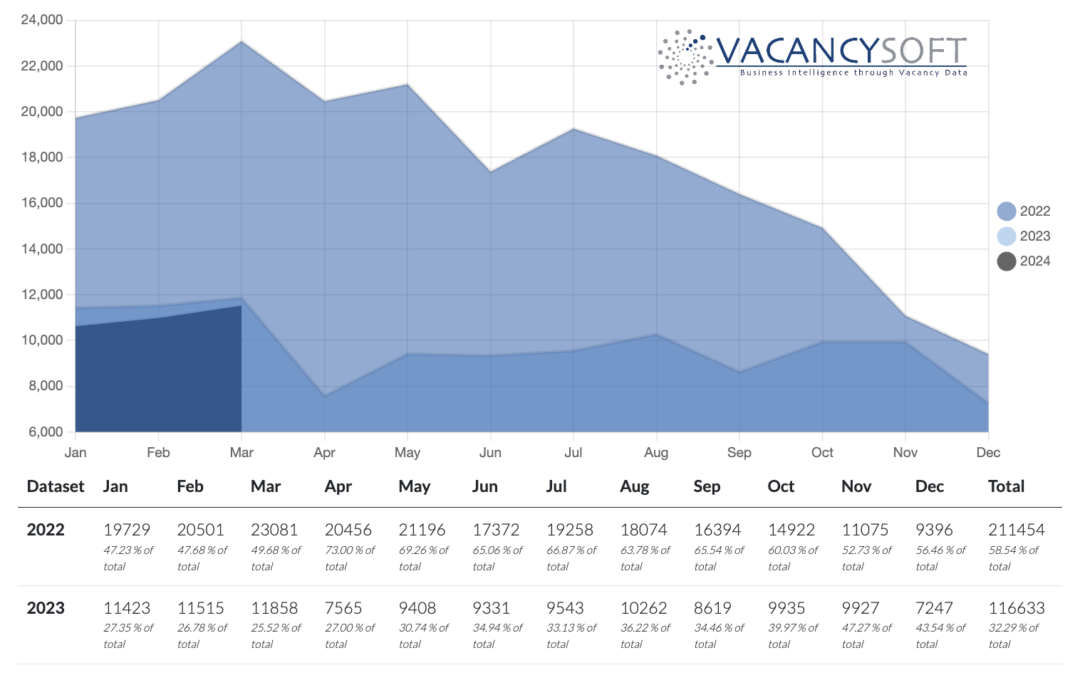

As we approach the end of April, the general consensus is that the market is on the up, that Q1 was a busy quarter and there is positive sentiment, looking ahead. When you compare Q1 2024 to Q4 2023, it is not surprising for sentiment to be as such, after all, there was an 18% increase in vacancies quarter on quarter!

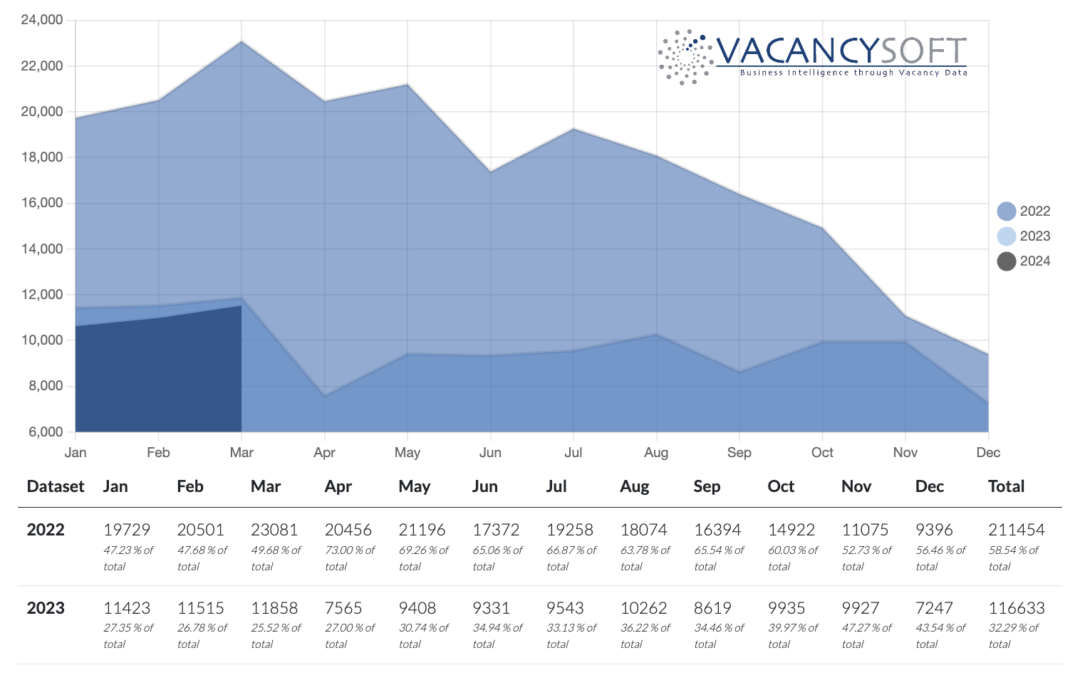

Job vacancies in 2023 fall by 23.7% compared to 2022, according to the latest UK Labour Market Trends report by leading professional body APSCo and labour market data analysts Vacancysoft.

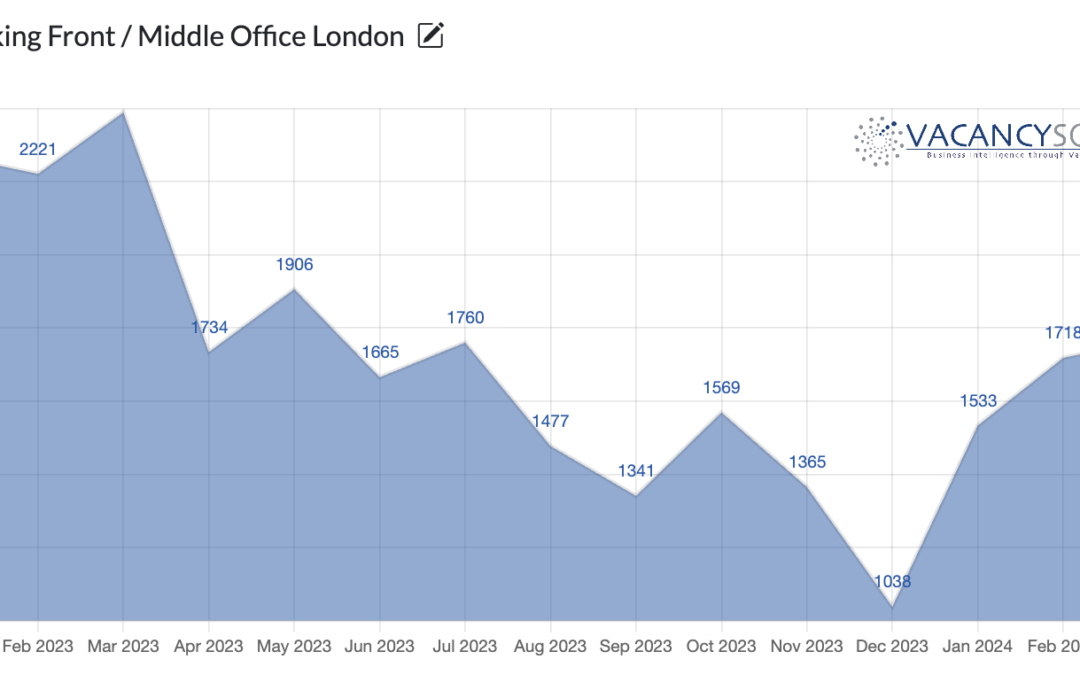

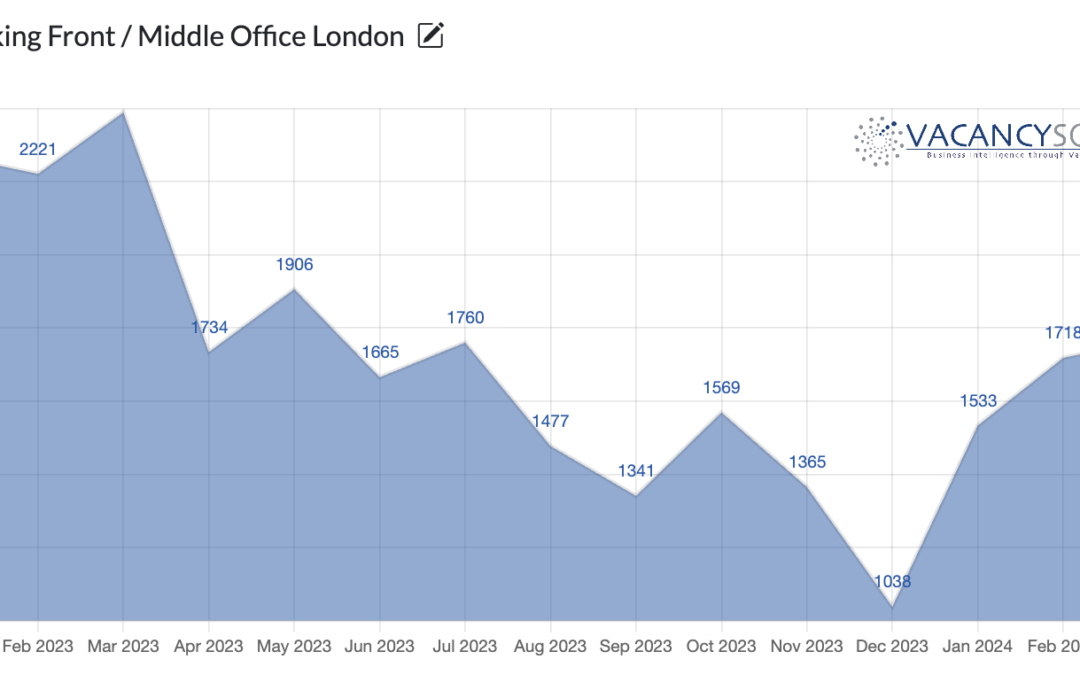

Financial Services is one of the largest industries within the UK, and contributes 8.3% to economic output. Overall the Financial Services industry employs over 1m people in the UK, and also runs significant trade surpluses, as a result, what happens in Banking is of direct relevance to the entire economy, and London in particular is of significance.

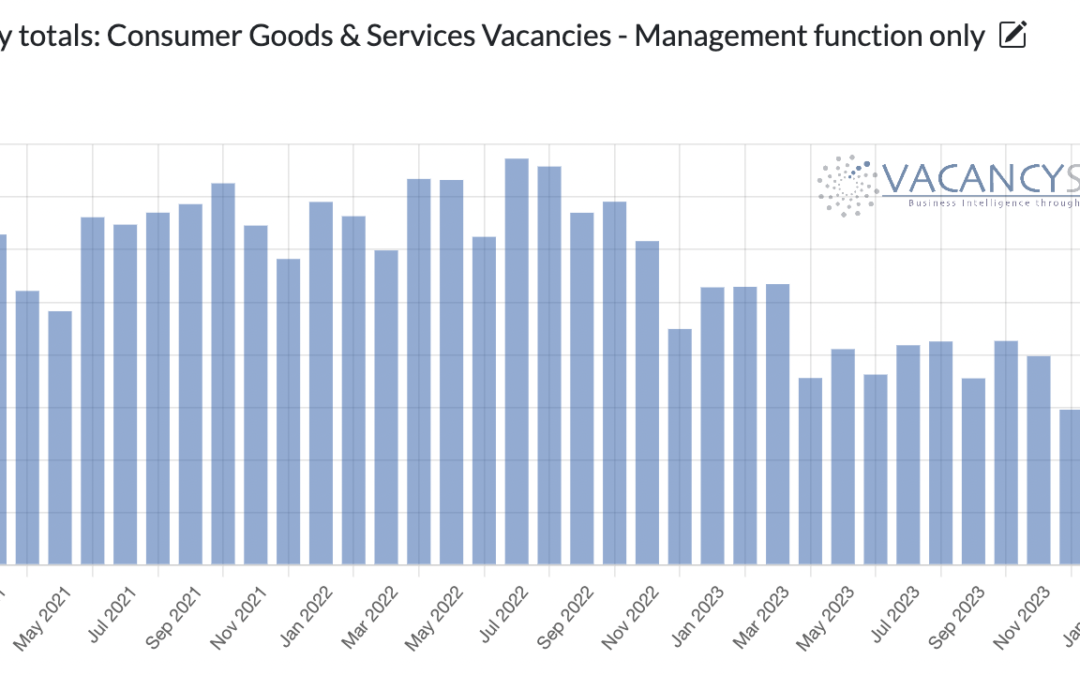

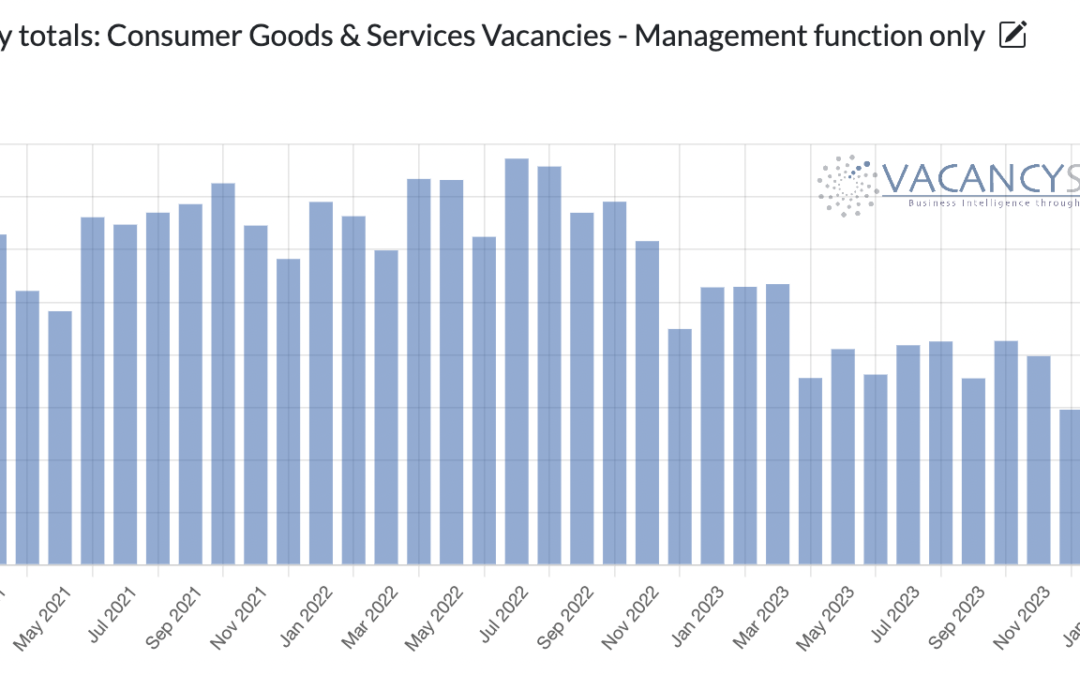

With the clocks changing and the days getting longer, there becomes a tangible shift in the mood of the nation. Typically that translates into a pick-up in activity for retailers. Indeed, Since 2021, the only time that Q2 performed worse than Q1 was last year, equally, that did coincide with the sharp downturn in the economy caused by quantitative tightening, which instantly acted to squeeze the economy.

According to the latest Life Sciences Labour Market Trends report by CPL and market data analysts Vacancysoft, key recruitment trends show that in 2022, there were over 4,100 new scientific vacancies published in the ‘Golden Triangle’ (Cambridge, London and Oxford). This translates to a slight decrease from 2021, when there were over 4,500 jobs, resulting in a year-on-year fall of 9.1%.