Claims continue to grow, with recruitment within insurance firms persisting across all sectors. The escalating impact of climate change on the property sector is evidenced by a long-term increase in insurance claims payouts, surpassing those of a decade ago.

After enduring a challenging six months, which ultimately led to the UK entering a technical recession, signs of recovery are finally beginning to emerge. The North West region has managed to increase its share of the national total from 7.5% in 2022 to 8.5% in 2023. Turning to the current year, we observe an uptick in the northwest’s monthly average, increasing by 5.3% compared to 2023, which bodes well for regional recruiters.

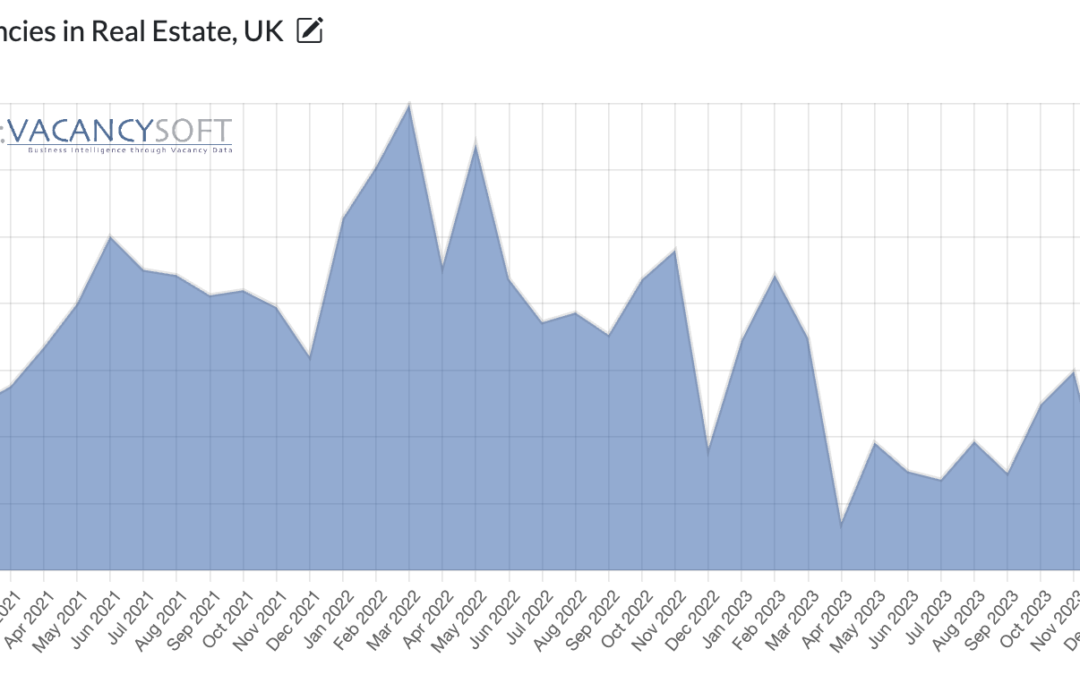

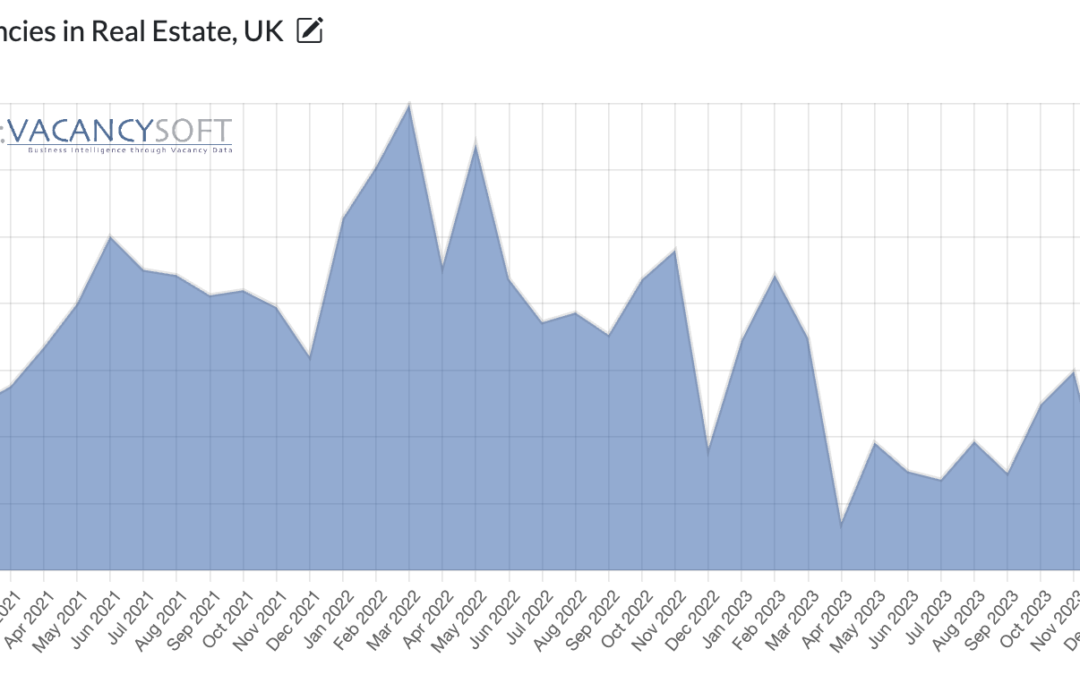

After all, following 2023, the real estate industry is showing signs of picking up as interest rates fall. Residential Property, in part due to the chronic shortage of new houses being built, is already seeing prices rise. With commercial property, there is a deeper question about what kind of work space businesses want, in this new pandemic period. Insofar that nationwide, occupancy is still below pre-pandemic levels, some areas are doing better than others.

The beginning months of 2024 have shown a decrease in recruitment compared to the post-pandemic boom seen in 2021-2023. Despite a dip in 2020 due to the pandemic, the Australian legal market experienced robust growth over the following years.

As Russia re-elected Putin this weekend, the impact on the UK is being seen in more ways than one. Already, Grant Schapps is talking about the need for further defence spending as we move from a post-war to a pre-war world. Meanwhile, the avenues for money to be funnelled into London are slowly closing, and the determination to minimize access is clear. The decision to double the economic crime levy for very large companies from April, to £500,000 per institution is a reflection of that.