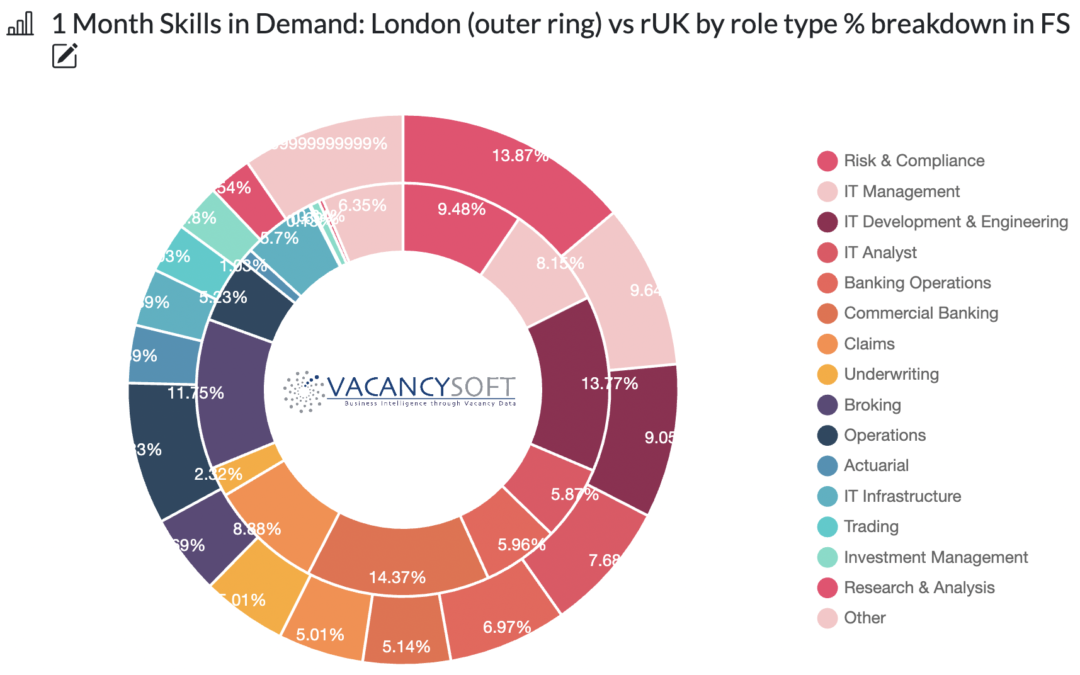

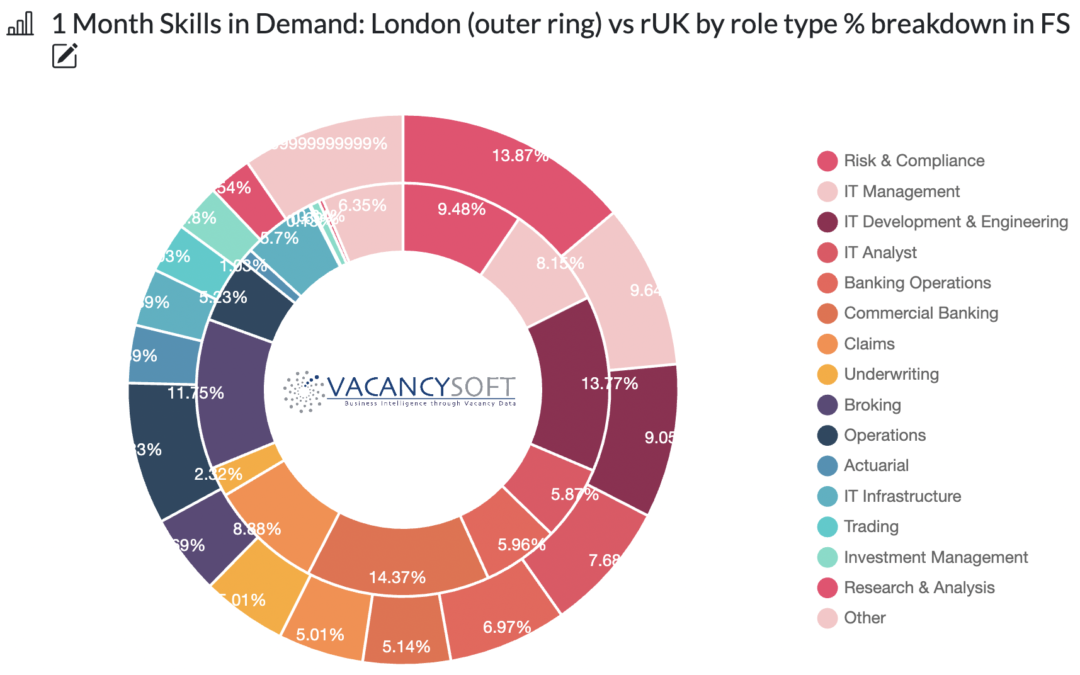

As one of the largest insurance markets in the world, the UK industry is surpassed in size only by the U.S., China, and Japan, where London is at the heart of that. With that, since quantitative tightening was initiated last summer, nearly all other market segments have slowed down in the capital. Not with Insurance, with January 2023 hitting all-time record levels according to Insurance specialists Harrison Holgate, and labour market data analysts Vacancysoft.

The long-term impact of COVID has yet to be felt on the economy. Equally, the societal change is already here. Work from home and hybrid is now becoming de-rigeur, where for people with London based jobs, it is increasingly a pre-requisite, especially when factoring the commute times. This is creating its own conflict within Financial Services, especially, as banks push for people to be back to work, equally are increasingly flexible about which work location is used. For example, HSBC now employs more people in Birmingham than in London.

Recruitment in the UK insurance industry has remained remarkably resilient as the regulatory changes and pricing reforms introduced by the Financial Conduct Authority (FCA) in 2022 to protect consumers have forced companies to make changes and focus on technology and digital platforms to meet the evolving needs of their customers, according to the latest finance report by Harrison Holgate and labour market data analysts Vacancysoft.

How are scientific vacancies faring in the Golden Triangle’s life sciences industry? Which sector had the best performance? Which are the skills most in-demand and which firms are the busiest? Download our new report to find out.