Executive Comment

Insights on the market from the Vacancysoft CEO, James Chaplin

Check the latest posts

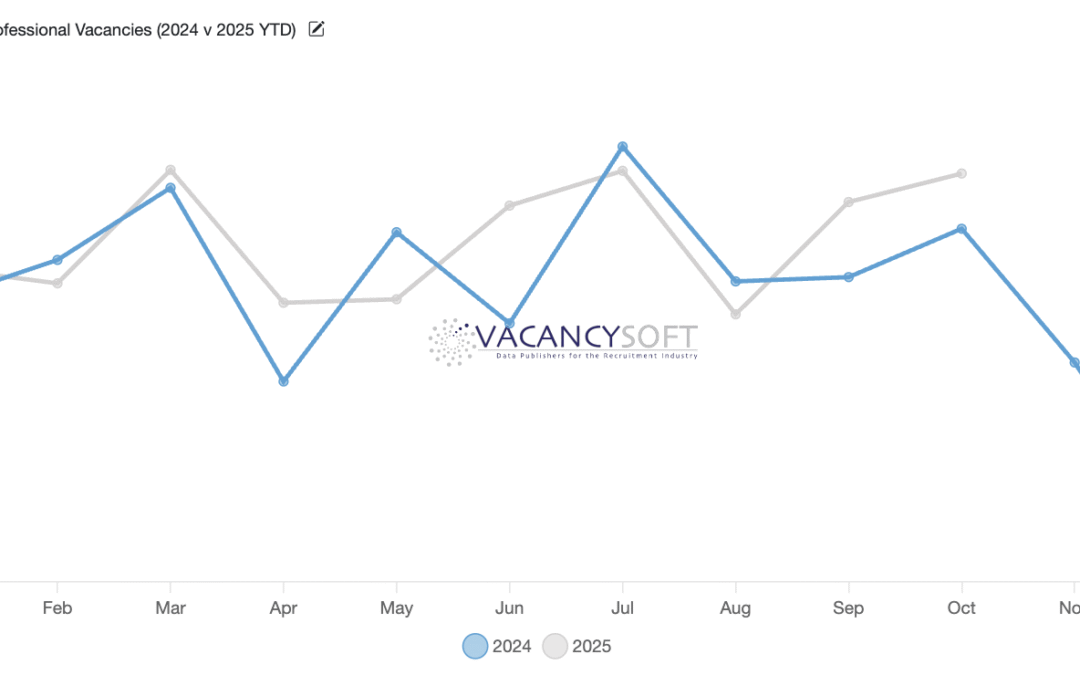

Annual Summit

At its annual summit, Vacancysoft reported uneven labour market impacts from Britain’s industrial strategy, with rising demand for tech and AI talent, strength in banking, telecoms and defence, but weaker hiring in insurance, energy and life sciences despite policy momentum. The findings highlight a growing skills mismatch in areas like engineering and data science, underscoring the need for closer alignment between education and industry to translate strategy into jobs.

Annual Summit – How the £80bn Industrial Strategy Is reshaping the UK jobs market

The UK’s £80 billion industrial strategy is driving investment into priority sectors such as artificial intelligence, clean energy, life sciences and telecoms, but early job gains remain concentrated, uneven, and in some cases delayed by regulatory and structural constraints. As geopolitical pressures and political uncertainty grow, questions remain over how widely employment benefits will spread and whether the strategy would survive a future change in government.

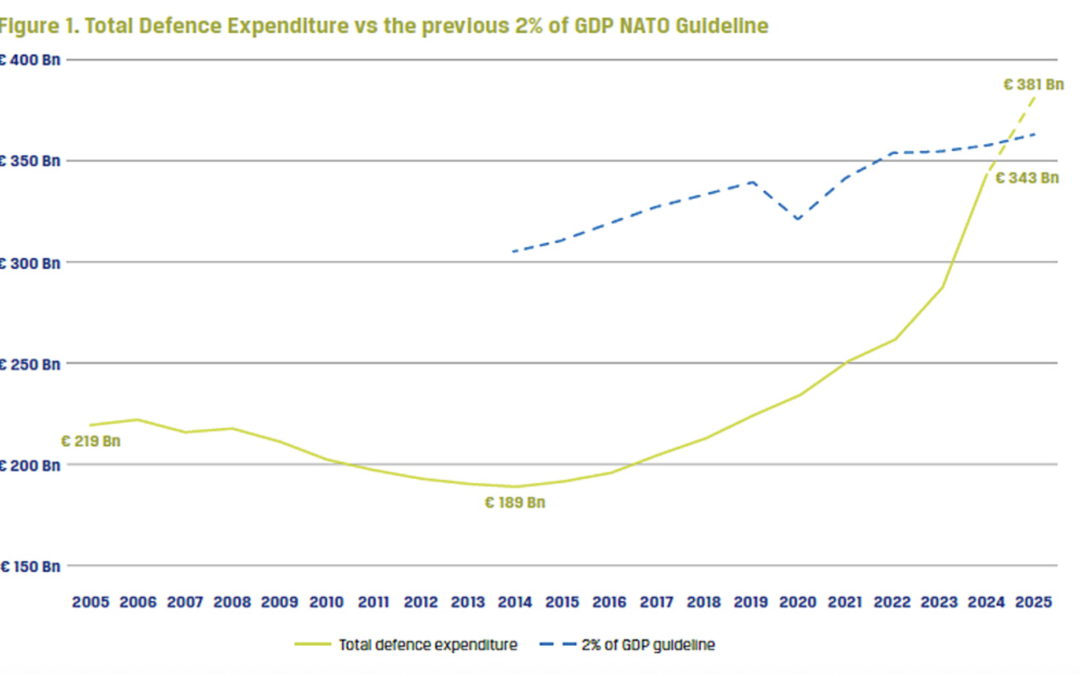

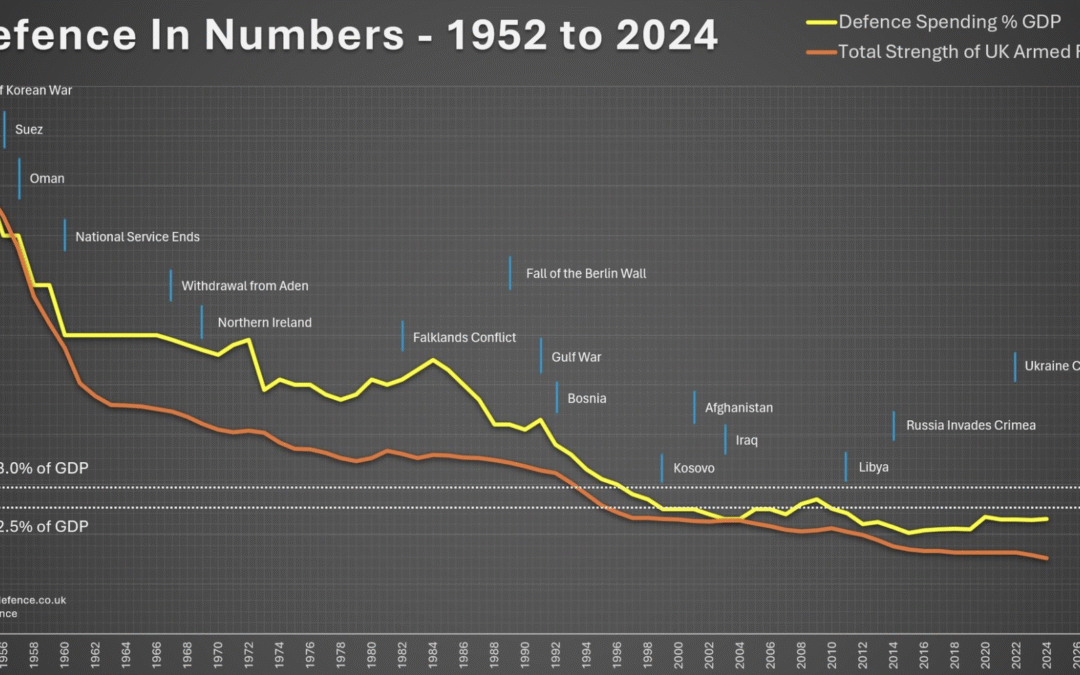

Can NATO survive Trump?

Trump’s stance on NATO and Greenland signals a potential collapse of US security guarantees to Europe, forcing the EU to pursue military self-reliance amid a historic transatlantic rupture. For Britain, this shift brings economic risk but may open the door to closer ties with the EU as global alliances realign.

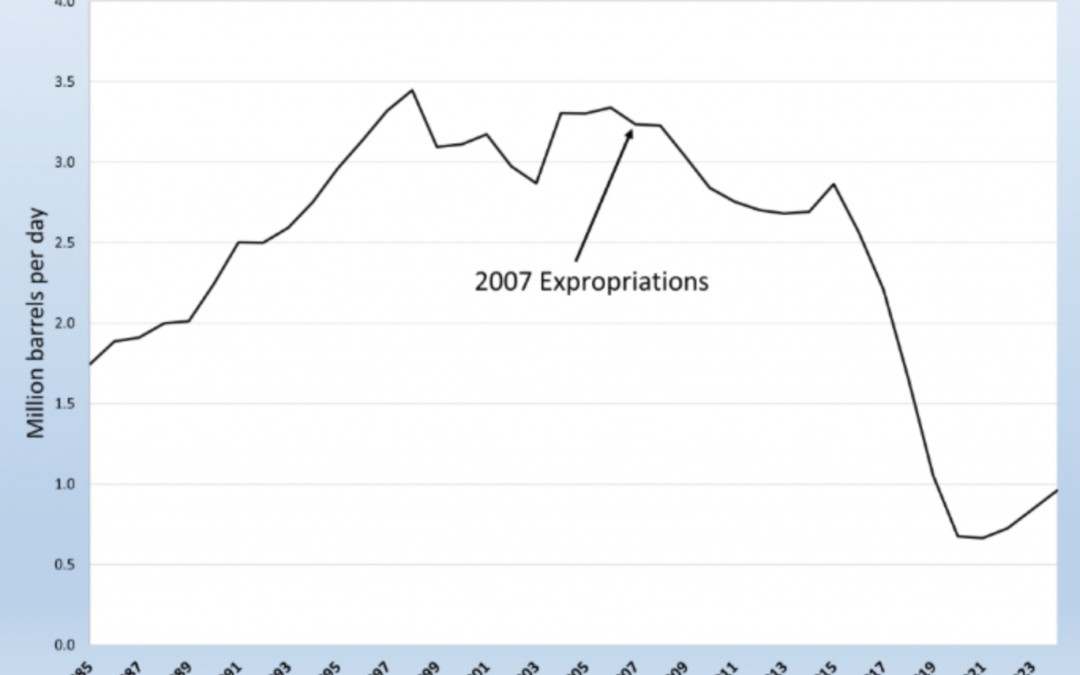

A turning point for Venezuela

Venezuela’s collapse stems from political failure, not lack of resources, and that reviving oil production with US backing could rapidly restore growth. It suggests outcomes ranging from new elections to the controversial but plausible scenario of Venezuela becoming a US protectorate to ensure stability and investment.

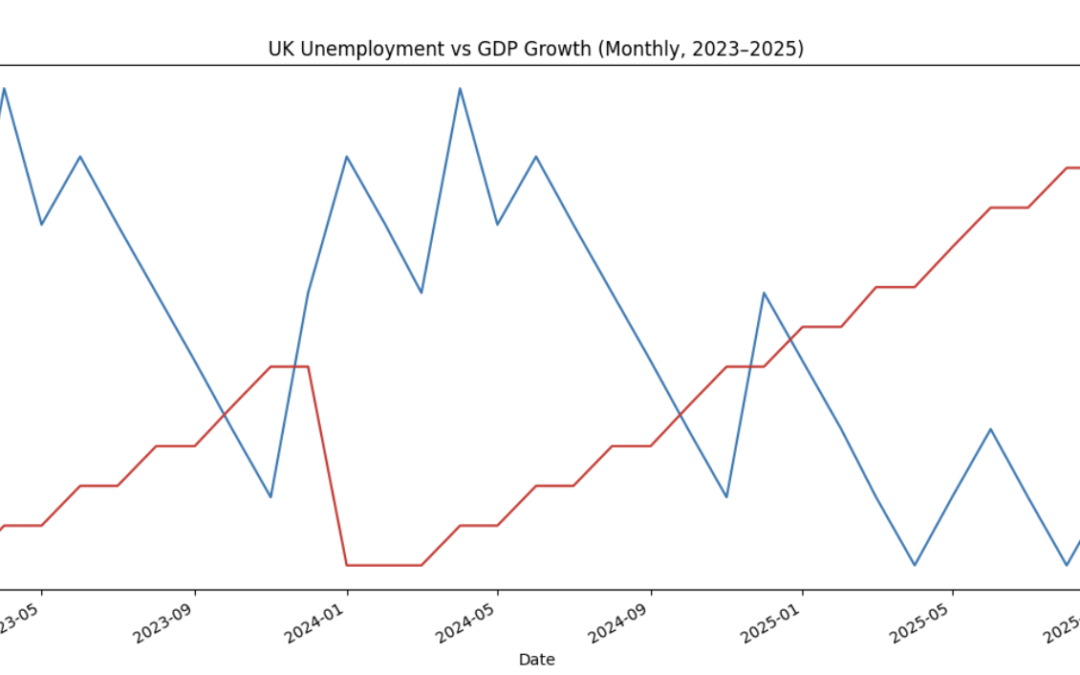

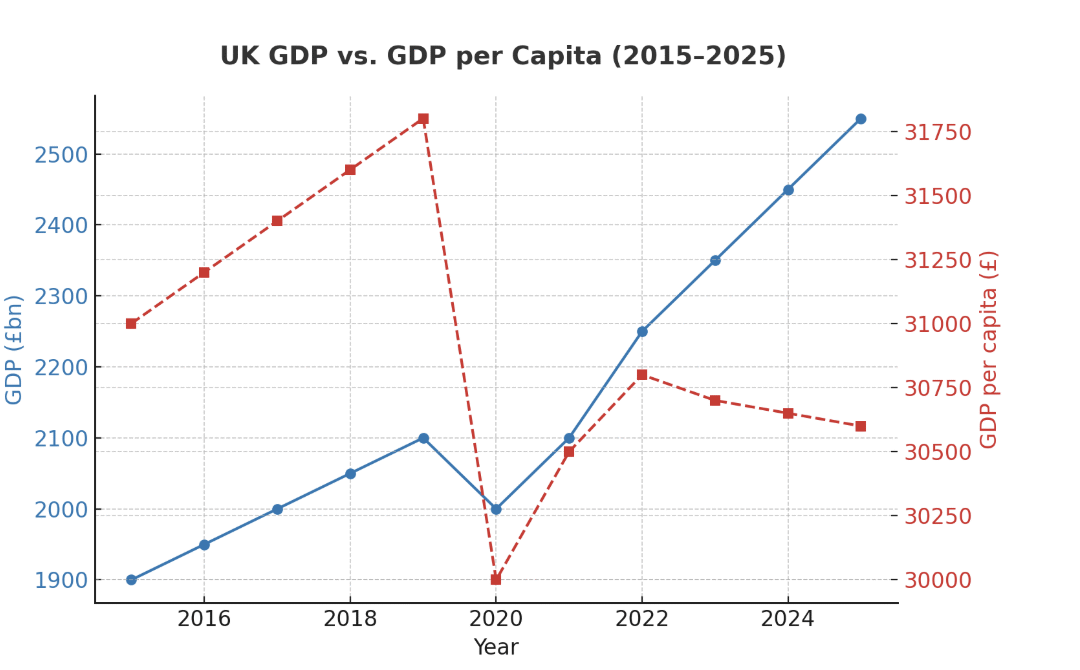

Private sector growth falters as Unemployment Rises

The UK economy is faltering, with rising unemployment, weak private-sector growth, and record-low business confidence. Labour’s industrial strategy has yet to deliver, leaving economic and political pressure mounting. Restoring confidence will require targeted business support, clearer regulation, and credible pro-growth policies.

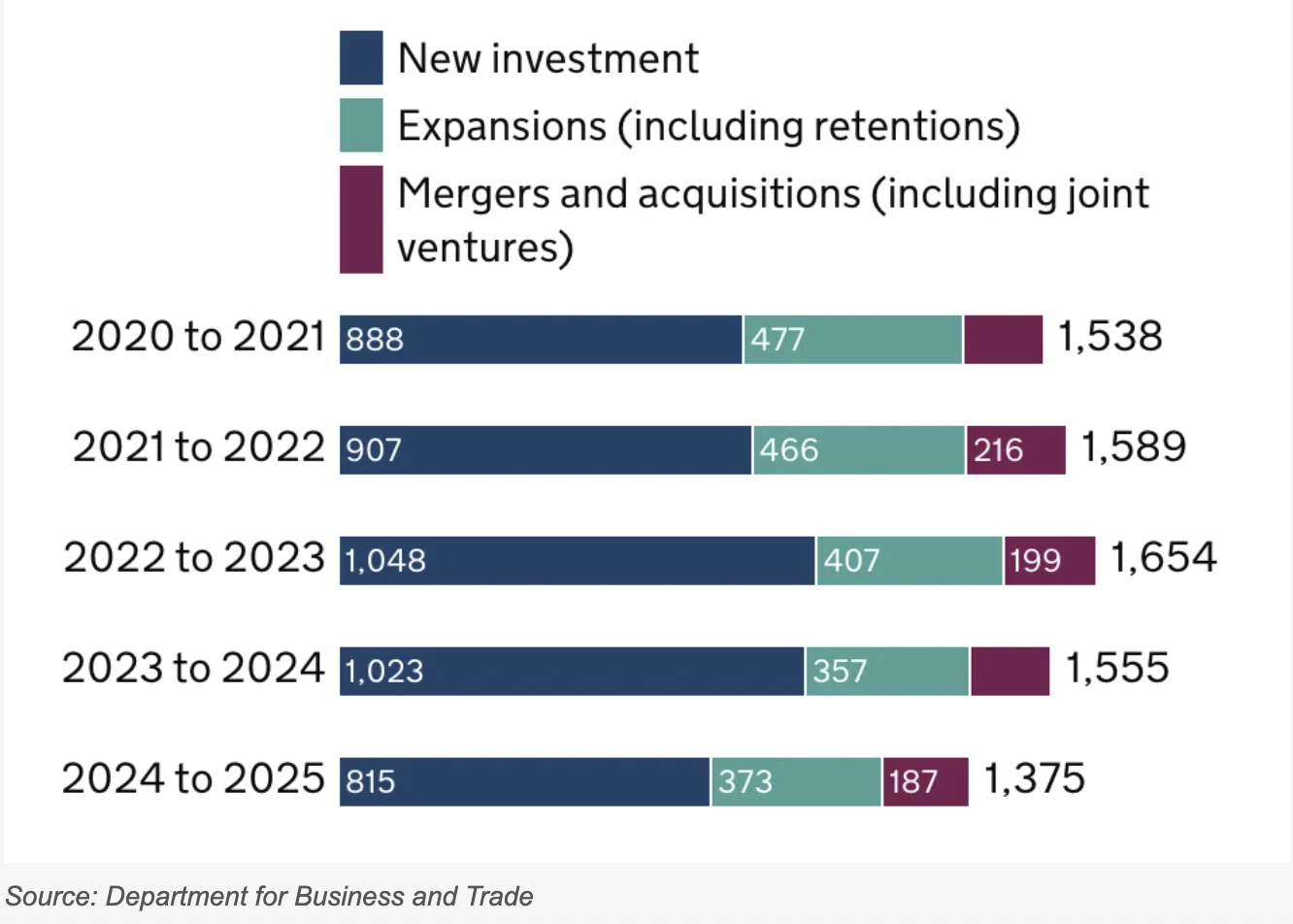

Vacancysoft Launch the IS-8 Vacancy Index

The UK’s new Industrial Strategy (IS-8), launched in June 2025, commits over £86 billion to boost productivity, innovation and competitiveness across eight key sectors — from Clean Energy to Life Sciences. Early indicators show rising investment and job creation, particularly in AI, Energy and Defence, as the government accelerates efforts to drive industrial growth.

Could the war in Ukraine end this winter?

Ukraine’s defence sector is rapidly transforming amid ongoing conflict, with homegrown technologies like the long-range “Flamingo” missile boosting military autonomy and shifting the strategic balance. As Russia’s economy weakens under falling energy revenues and rising costs, pressure is mounting for a ceasefire — especially if the rouble again breaches 100 to the dollar, a threshold that could make continued war unsustainable.

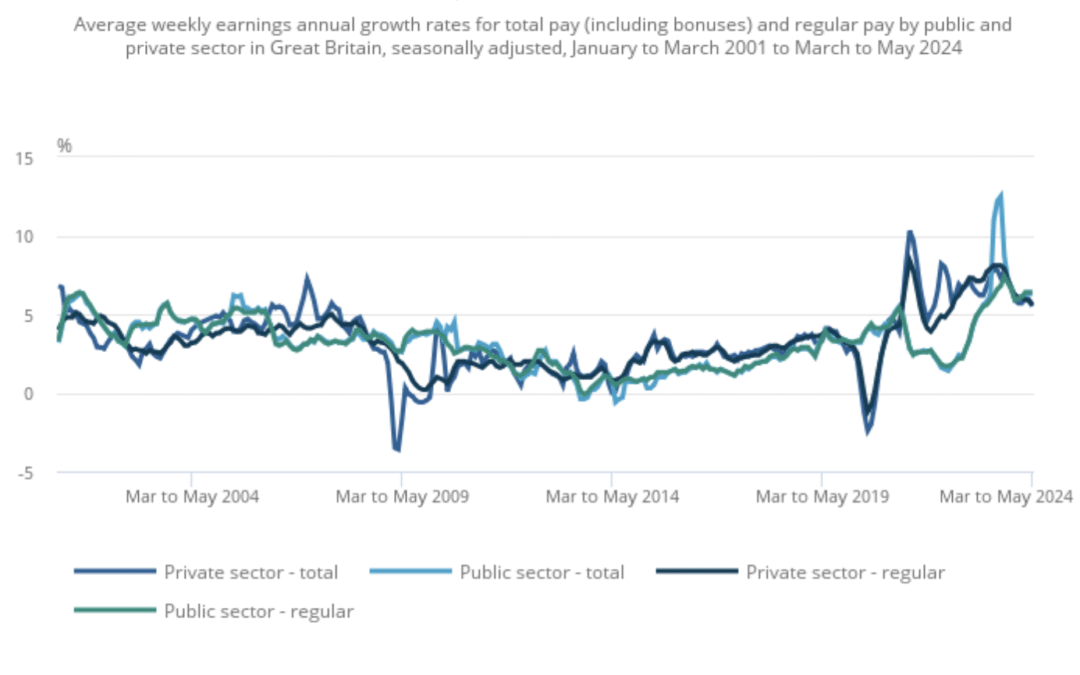

Private Sector Pulls Ahead While Public Sector Lags

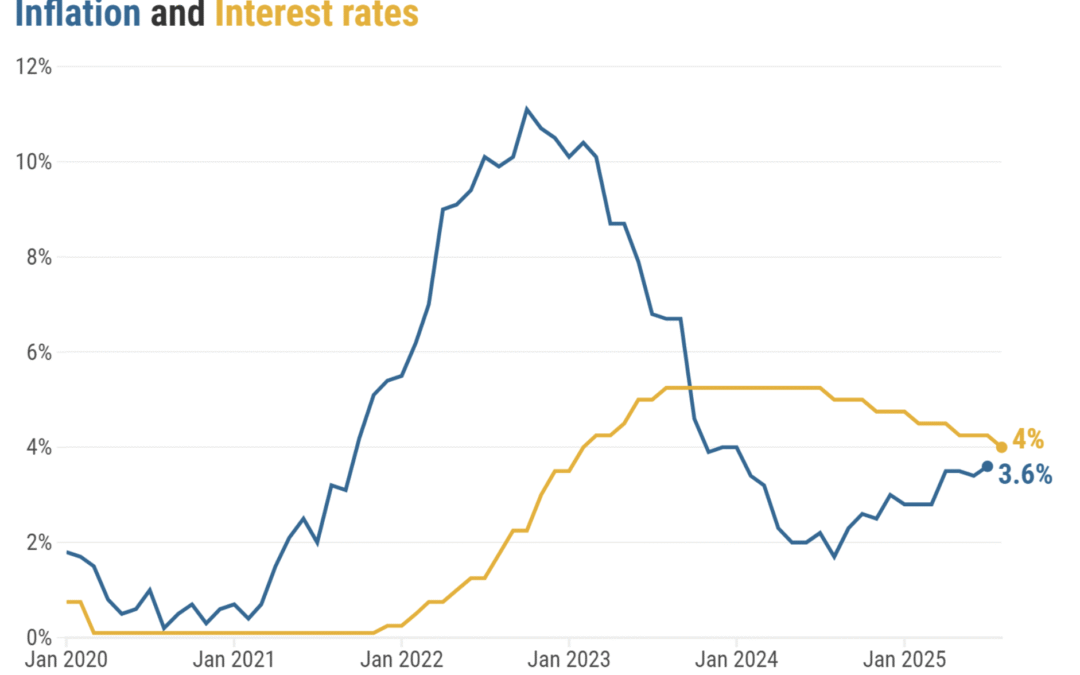

UK pay growth is diverging, with public sector wages up 6.0% versus 4.4% in the private sector, while productivity continues to lag. Economists warn this imbalance risks fuelling inflation as firms turn to AI and automation to offset rising labour costs

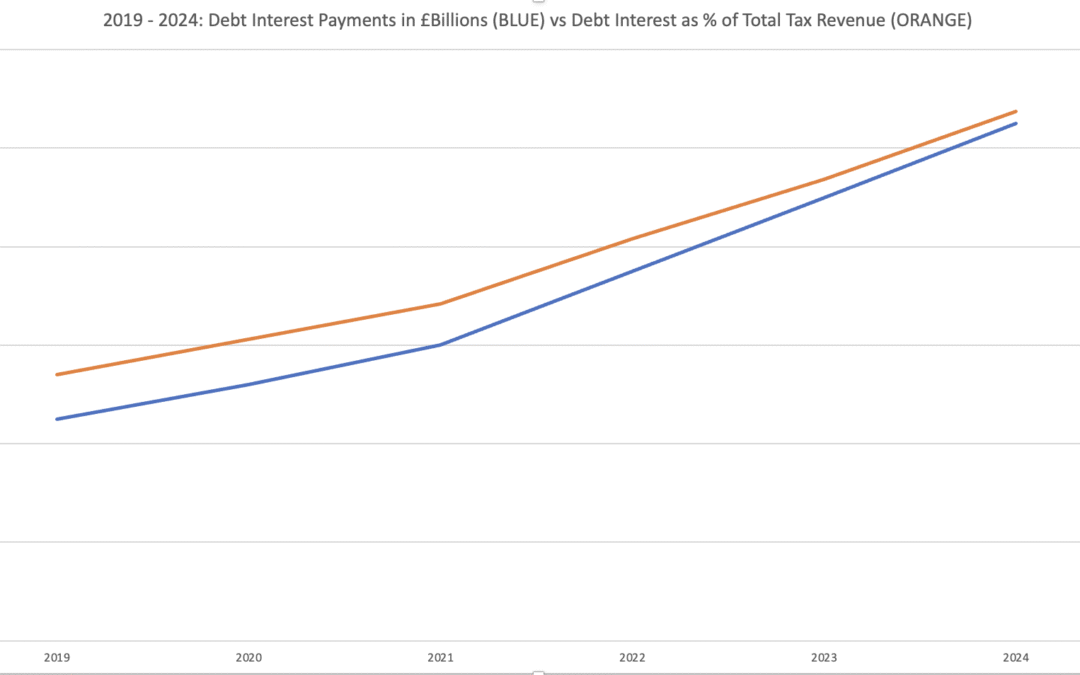

The Political Parties are now polarising on Economic Policy

UK borrowing costs have hit a 27-year high of 5.7%, with debt interest now consuming 17.9% of tax revenues—up from 9% in 2019. Inflation-linked bonds and a widening deficit are intensifying fiscal pressure, as the government faces tough choices between tax hikes, spending cuts, and market confidence.

The Deepening Youth Employment Crisis

The number of young people in the UK not in education, employment or training has risen to 948,000 — a 22% increase since before the pandemic. A new government scheme promises work placements for long-term claimants, but questions remain over sanctions, job quality, and whether it tackles the deeper structural issues driving youth unemployment.

The President who brings gifts

The UK has secured over £150 billion in U.S. investment, spanning financial services, AI infrastructure, nuclear energy and R&D. Microsoft alone will commit £22 billion, while Rolls Royce gains a U.S. license for advanced modular reactors. The projects promise thousands of high-paid jobs across the UK, though concerns remain about reliance on foreign capital and skill shortages.

Putin tests NATO’s resolve

Poland’s invocation of Article 4 after Russian drones entered its airspace highlights growing tensions on NATO’s eastern frontier. With joint Russian-Belarusian drills near Poland, the vulnerability of the Suwałki Gap, and doubts over U.S. commitment, the Alliance faces urgent choices on rearmament and deterrence.

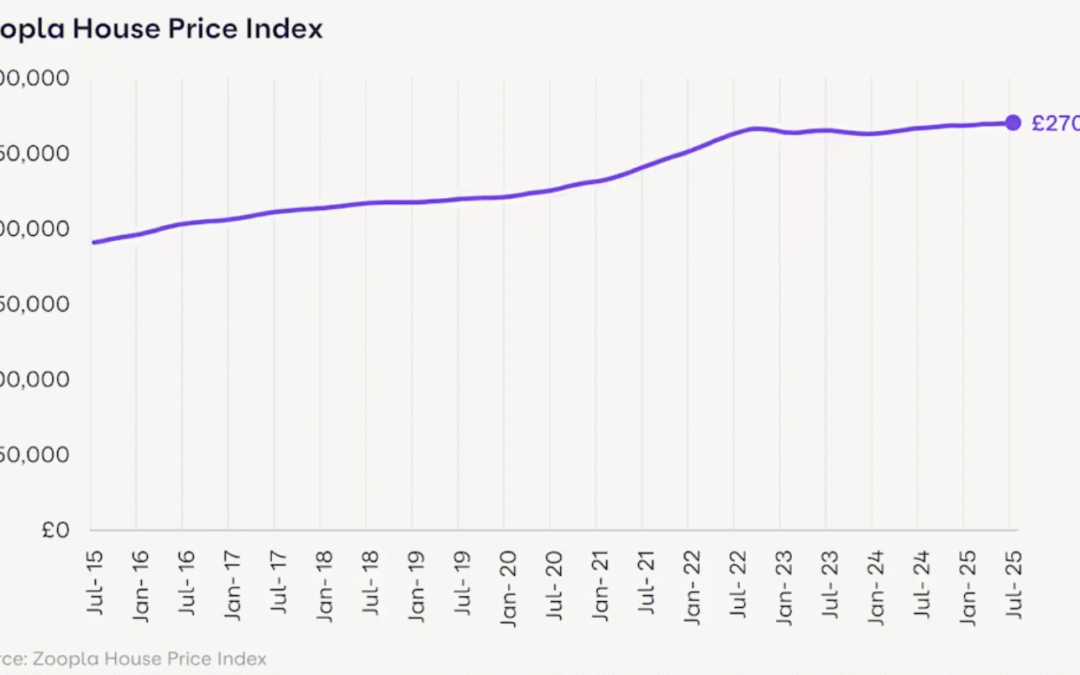

The end of the property boom

The UK housing market is under strain as rising interest rates, new regulations, and potential wealth taxes squeeze landlords and stall house prices. With construction costs climbing and buyer demand weakening, builders, landlords, and the wider labour market all face mounting pressure.

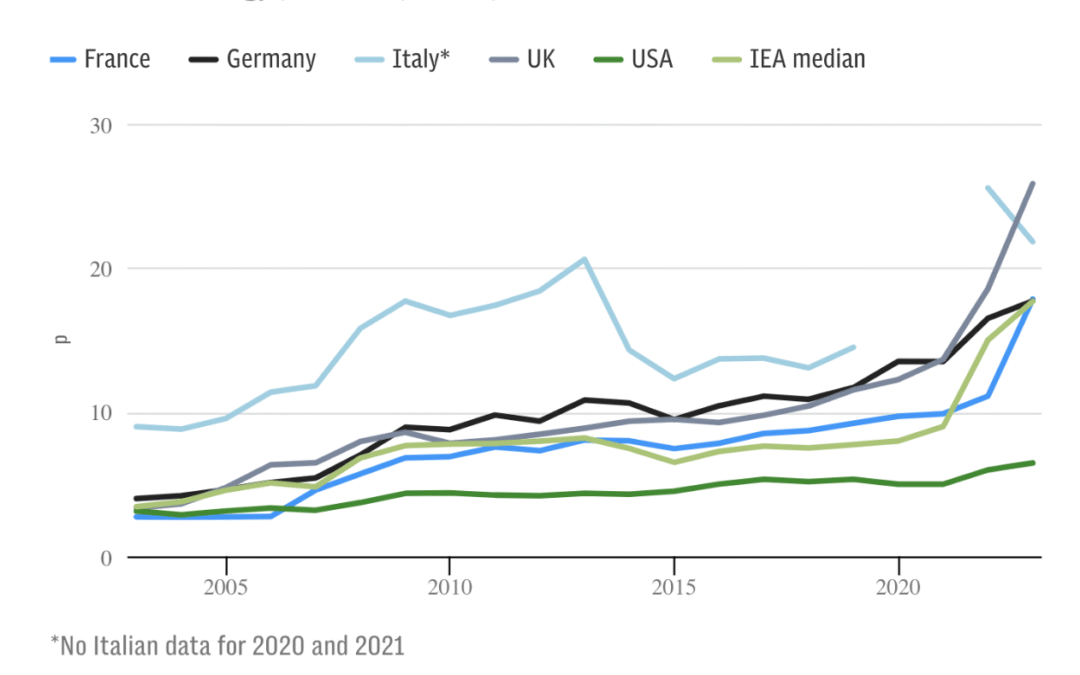

UK Risks Falling Behind In Global AI Race

Britain’s push to be both an AI superpower and a climate leader faces a growing energy crunch. Data centres demand heavy power, costs are soaring, and grid upgrades lag behind. Without credible solutions, the UK risks losing tech investment and undermining its green ambitions.

A briefing from Ukraine

Russian diplomacy remains uncompromising as the Ukraine war grinds on. Despite staggering losses and economic strain, Putin still bets on escalation. Yet Europe is rearming at historic speed, Ukraine grows more resilient, and the endgame draws closer. The outcome will reshape Europe’s security for generations to come.

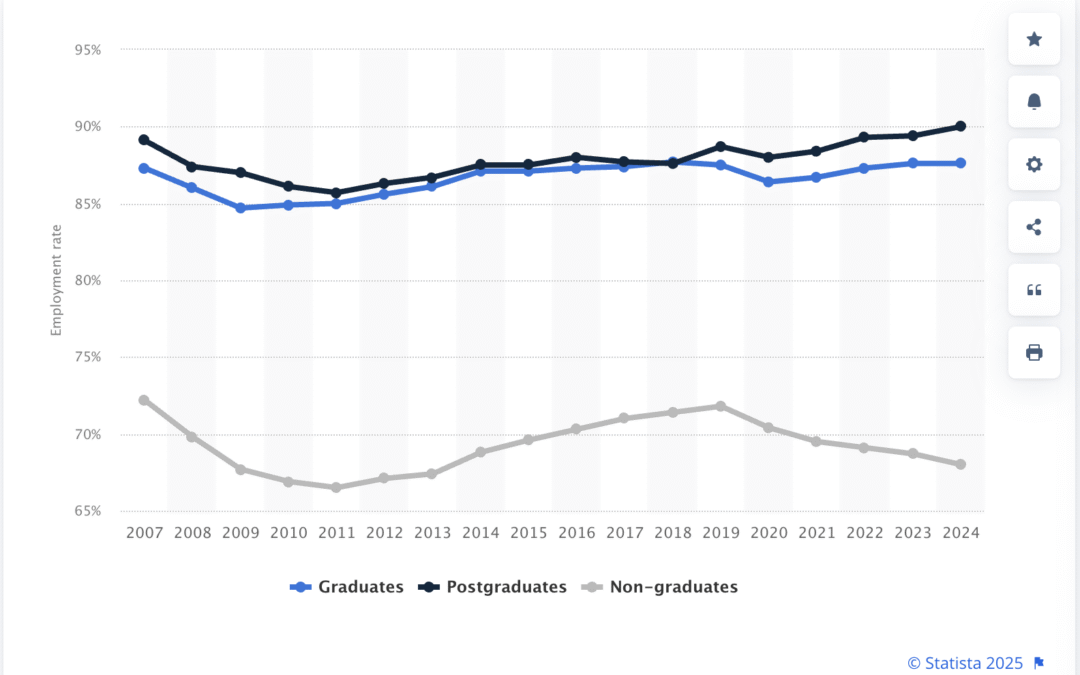

The Graduate Crisis

Artificial intelligence is reshaping the graduate job market, cutting entry-level roles across law, finance, media, and more. As traditional career ladders disappear, success will depend on adaptability, entrepreneurial thinking, and skills AI can’t replace. Britain’s education system must evolve to prepare graduates for an AI-driven economy.

Bank of England Votes Narrowly to Cut Rates

The Bank of England has cut interest rates to 4%, but rising inflation and a divided vote signal a cautious path ahead. With food prices and unemployment both climbing, businesses face growing uncertainty as the UK economy grapples with stagnation, weakening investment, and policy trade-offs.

US Escalates Tariffs Over India-Russia Defence Links

India’s rising trade with Russia is drawing scrutiny as global tensions escalate. With US tariffs looming, New Delhi faces a pivotal choice between cheap oil and strategic alignment.

EXPLORE